Cool Tips About How To Apply For A Sba Loan

19 hours agowith the option to draw down money as needed, a business line of credit can be the right move for businesses that are concerned about cash flow issues in the future.

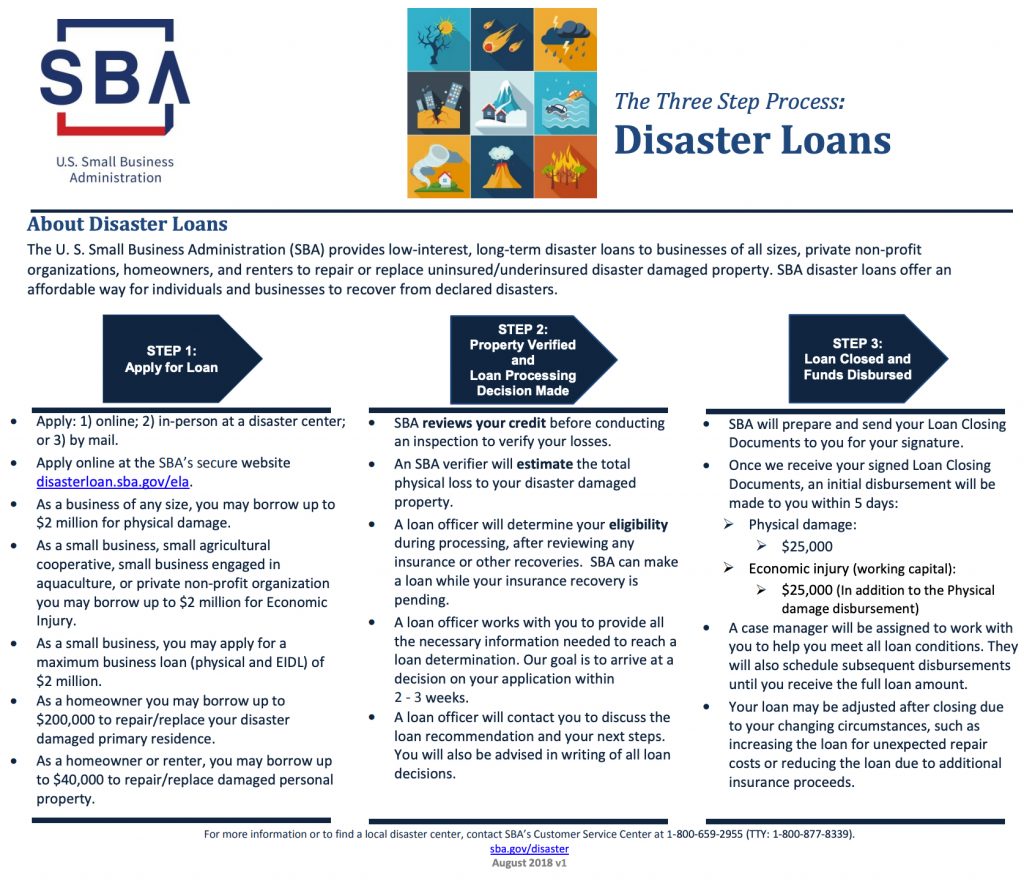

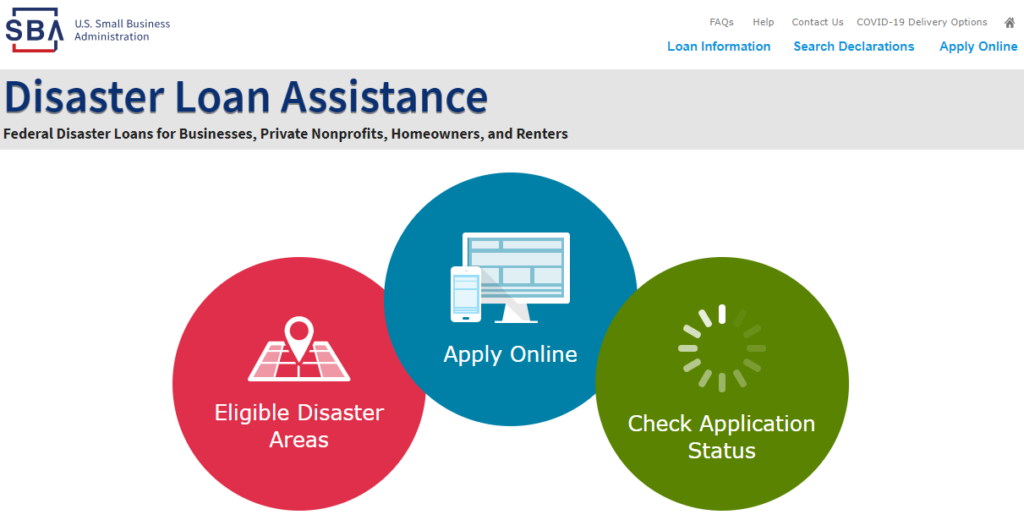

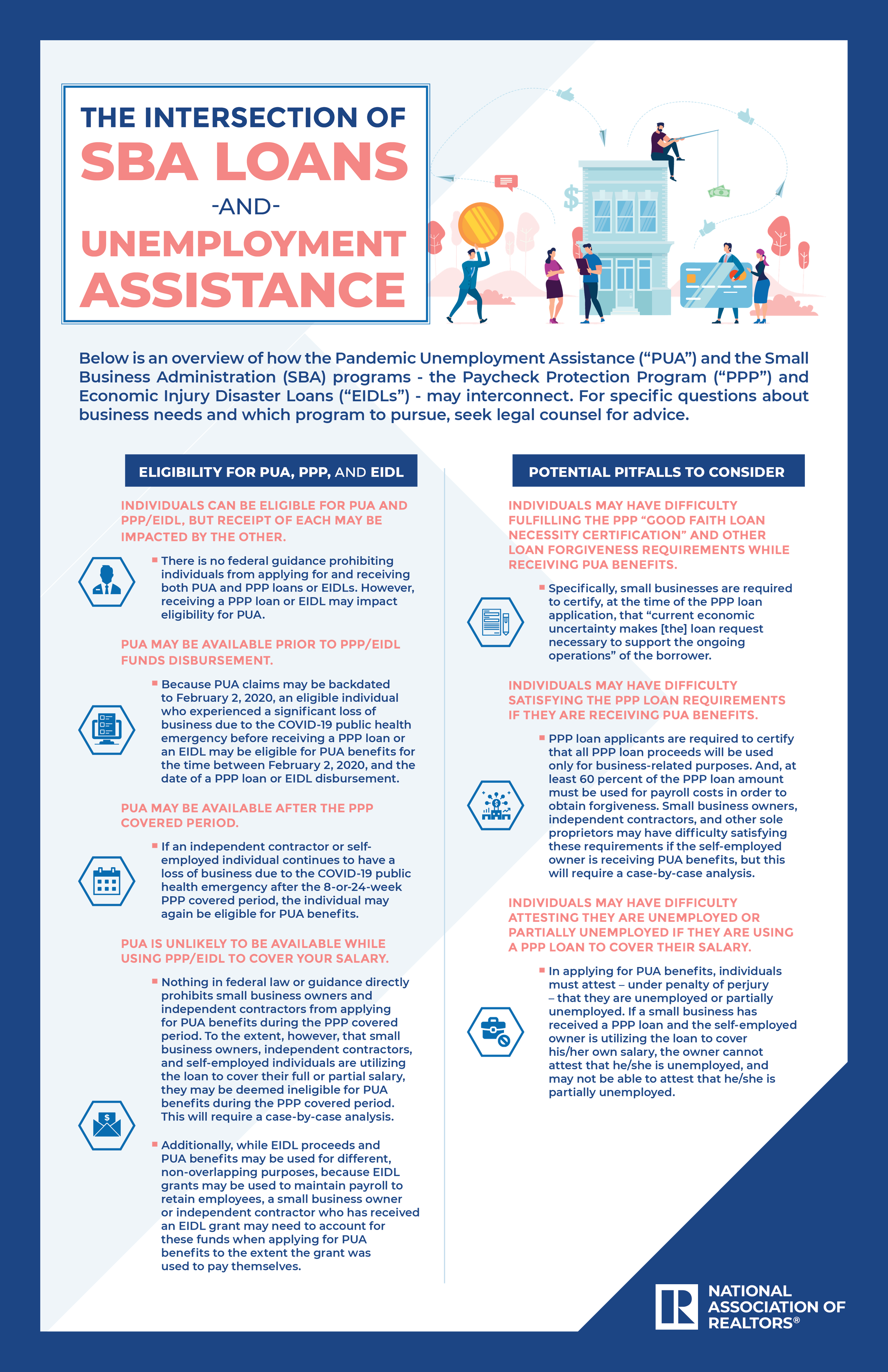

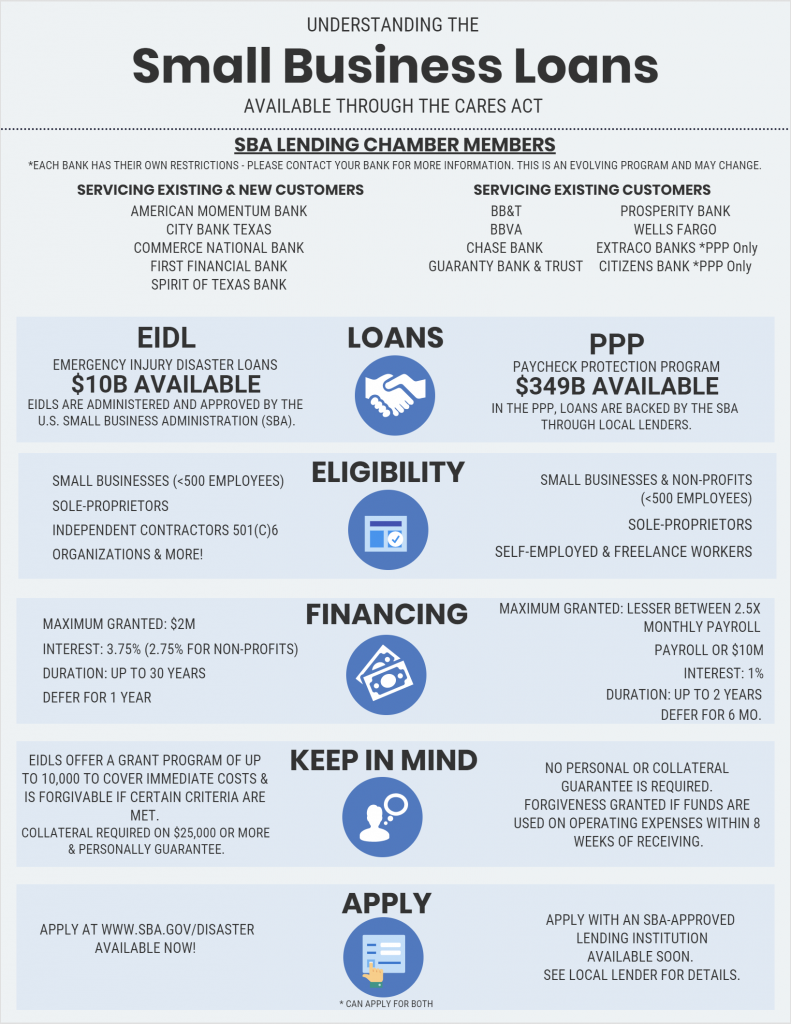

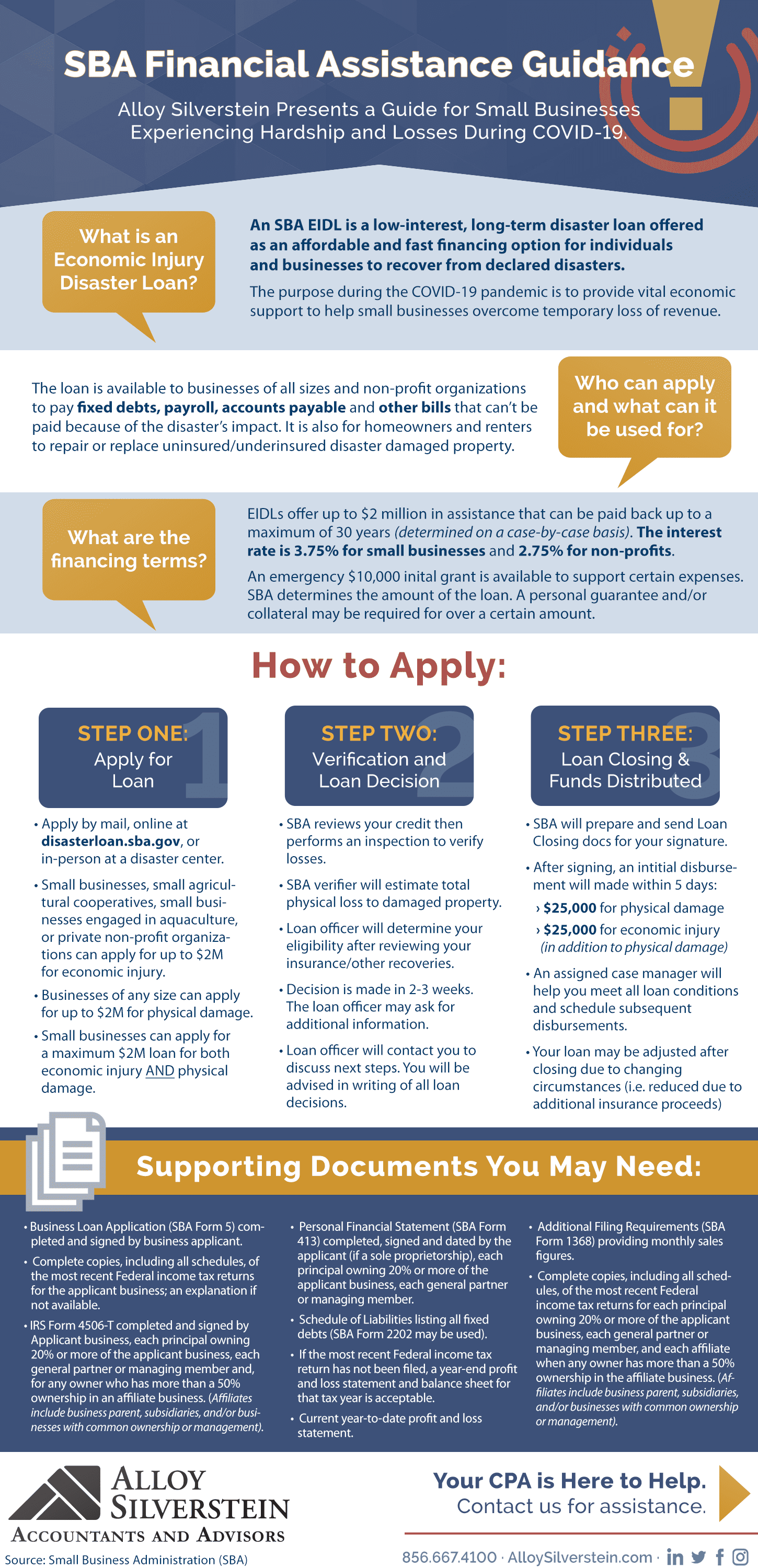

How to apply for a sba loan. Organizations can use sba loans for a wide range of business purposes, but your intended use of funds may determine which sba loan program is best suited to your needs. Start or expand your business with loans guaranteed by the small business administration. There is also help for homeowners and renters.

These are the best sba loans in america. Ad sba loans are designed to make it easier for small businesses to get funding. Fill out our application in minutes and see what sba loans you can get for your business!

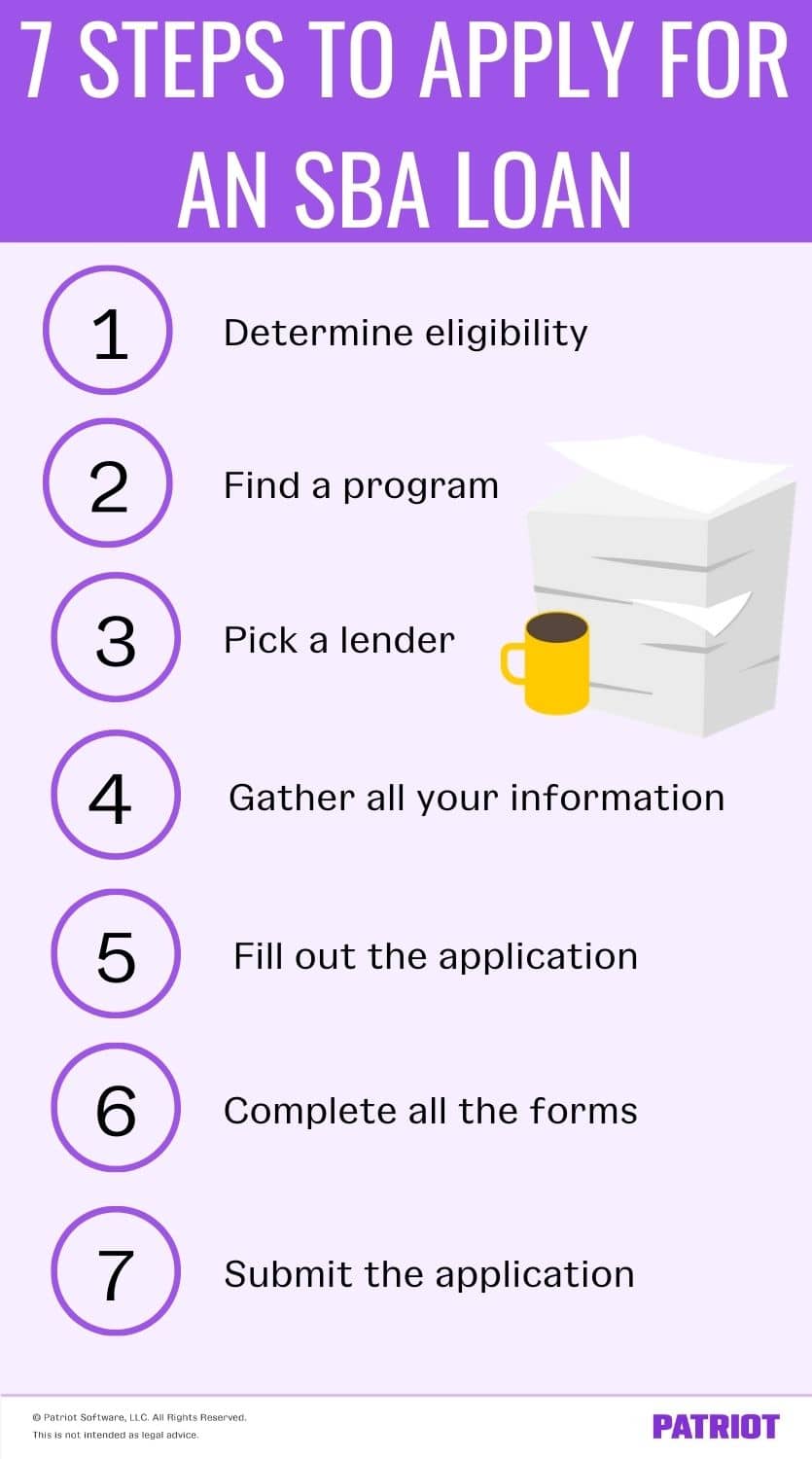

The application process for 504 loans differs somewhat from other sba programs, in that borrowers must work directly with a cdc and a private lender, rather than working. The process of applying for an sba loan is relatively easy, but you will need to follow these steps. The loans aren't just for small businesses.

This is a free event. Ad get funded & help your business grow! Other general eligibility standards include falling within sba size.

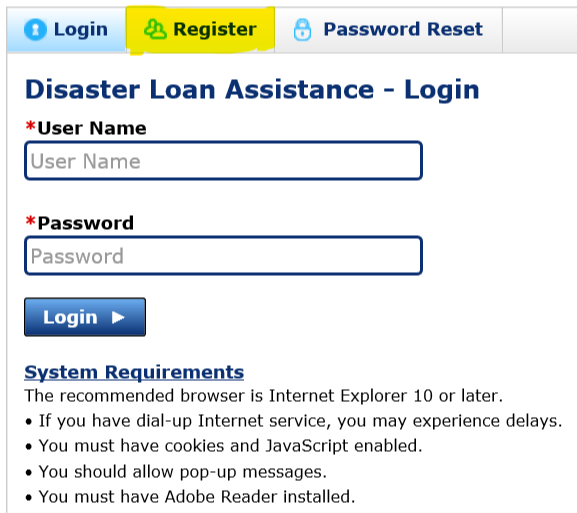

Once you have everything ready, you’ll submit your application to the lender. Applying for an sba loan is easier than ever with our streamlined application process. Flexible loans tailored to you.

How to apply for small business loans once you’ve found the right lender, you’re ready to start gathering the materials for your small business loan application. When you’re shopping for a lender, one important detail to know is. Apply for small business administration loan!